Ready to use legal template

Drafted by experienced lawyers

Compliant with Singapore law

Ready to use legal template

Drafted by lawyers

Compliant with Singapore law

Home › Accounting services › Payslips

Learn more about Payslip in Singapore

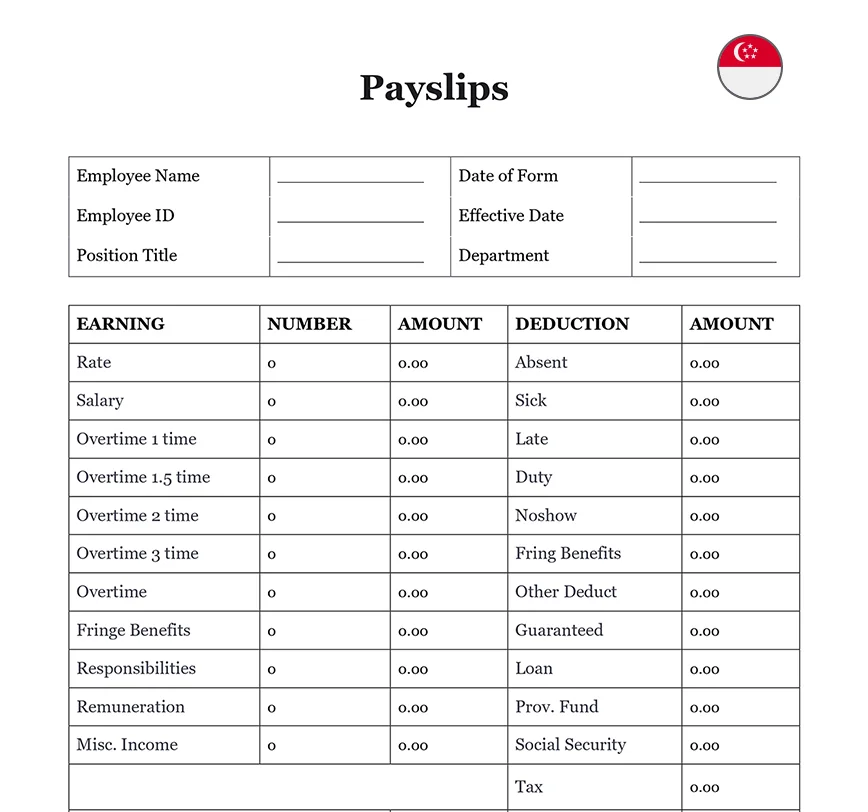

A payslip is an official document provided by an employer to an employee that outlines the details of salary payments, including basic wages, allowances, deductions, CPF contributions, and net pay. In Singapore, issuing itemised payslips is a legal requirement under the Employment Act and is essential for promoting transparency and protecting employee rights. Payslips help both employers and employees maintain accurate records of salary and ensure compliance with statutory obligations such as CPF and tax reporting. For businesses, a clear and consistent payslip format supports HR efficiency and builds trust within the workforce. Download our professionally drafted Payslip template designed specifically for use in Singapore. It is easy to edit in Word format and can be quickly customised to suit your company’s payroll system.

Table of contents

What are the advantages of utilizing a Payroll Service?

Here are five advantages of employing managed payroll services:

1. Maintain control

Many business owners are concerned about outsourcing because it implies a loss of control. However, with managed payroll services, you retain control because the engagement is detailed in the contract with the third party. With managed payroll services, you may pick and choose which operations you want to outsource and which you want to maintain in-house, if any.

It’s not an all-or-nothing approach. Partnering with a managed services provider is more adaptable and scalable. You may specify exactly what you want the third party to accomplish and guarantee that it is completed without the time-consuming chore of doing it yourself.

2. Risk management in compliance

Payroll and tax laws may be intricate and complicated. To reduce risks, you may have access to knowledge in legislation, government regulations, privacy, and security with the proper partner. Your partner will deliver services in an expedient, secure, accurate, and private way, allowing you to achieve regulatory compliance while also protecting your data from payroll theft and fraud.

3. Improved accuracy

When it comes to payroll, you must get the numbers correct or risk getting in problems with the IRAS and disappointing your employees. However, with differing tax rates, a plethora of different time sheets and pay scales, various benefits and coverage options, and voluntary withholdings, it can be difficult to get it right. When you engage in managed payroll services, you have assured accuracy, allowing you to ensure that your employees are paid accurately and on time, every time. You will not lose your employees’ faith if you fail to pay them overtime or enter their hours incorrectly, and you will not be audited by the government if the numbers are always correct.

4. Maintain cost control

Managed payroll services provide you the freedom to convert your fixed overhead expenditures into a flexible cost structure. This is especially significant during a recession: as your company expands or decreases, so are your service expenses.

If the workload does not justify the fixed cost, you will not be required to continue paying a large salary and benefits to a payroll clerk. You will also not have to pay for payroll software, equipment, training, or office supplies in order to prepare, process, sign, and print the checks. You’ll also get access to IT assistance, world-class hosting infrastructure, and software that you couldn’t otherwise afford.

5. Conserve time

When your HR department isn’t wasting valuable time on payroll system maintenance, your company may save time that can be spent on other vital tasks. Instead of spending hours manually entering data, researching legislation, and double-checking numbers, your HR professionals can devote time and resources to strategy and other critical activities that increase efficiency and productivity and optimize your workforce in order to better meet the needs of your customers and achieve your business goals at the lowest possible cost. Payroll processing must be properly handled to guarantee that business operations run smoothly. However, because it is not an essential job, adopting managed payroll services may be quite advantageous.

What is a Payslip?

A payslip is a document that details your employees’ wages. Payslips must include information such as your employee’s basic pay, overtime pay, bonuses, CPF deductions, and other salary-related issues. As a result, an itemised payslip can be used to give confirmation of wage amounts and payment.

Issuing payslips (and adhering to the stringent rules that will be discussed in further detail later) may appear to be extra work for firms and Human Resources departments. Employers, on the other hand, can provide employees with a sense of security and comfort that they are being paid properly by breaking down their employees’ salaries in a standardised payslip. This may convert into more trust and confidence in their employers, leading to the employees’ desire to continue working with them.

Furthermore, because the payslip clearly states all of the important monetary information relating to the employee’s salaries and benefits, employers may receive fewer salary complaints from employees or be able to resolve such complaints faster.

What information should a Payslip contain?

A payslip must include the following information:

| ➤ The amount of pay, both gross (before tax) as well as net (after tax) |

| ➤ The date of receiving the pay |

| ➤ The pay period |

| ➤ Any loadings, bonuses or penalty percentage entitlements |

| ➤ Deductions |

| ➤ Superannuation contributions such as the name of the super fund |

| ➤ The employer’s name and ABN if they have one |

| ➤ The employee’s name |