Ready to use legal template

Work on without any hassle

Compliant with Singapore law

Ready to use legal template

Work on without any hassle

Compliant with Singapore law

Home › Accounting services › Invoice

Learn more about Invoice in Singapore

An invoice is a document that shows a transaction or sale made by your company. It proves a creditor’s claim against a debtor, or a client’s debt to a supplier. This template shows the creditor (business), the debtor (consumer), the amount owed, and the date. It binds the debtor to pay the sum by the due date indicated. When selling/buying things, fixed assets, or performing a service, an bill of sale must be created. We provide a tailored solution for your Singaporean business as well as expert accounting help if required.

📄 Related documents

Table of contents

What is an Invoice?

An invoice is a document that enumerates the products and services that a company provides to a customer and establishes the customer’s obligation to pay the company for those services and goods. Invoicing is critical for small businesses since there are the legal documents that allow firms to get paid for their services. Invoice templates are a common method to get started. This template save you time by eliminating the need to re-enter the same data each time you create an invoice. It serve a crucial function for both the company that sends the bill of sale and the customer who receives it. It helps small businesses speed up the payment process by notifying clients when a payment is due. Invoices give an orderly record of a cost with itemized data for clients and can aid in record keeping.

Why use an Invoice?

Businesses must deliver bill of sales in order to request payment. An invoice is a legally enforceable agreement that demonstrates both parties’ agreement to the indicated price and payment terms. However, there are additional advantages to utilizing invoices.

1. Keeping records

The capacity to preserve a legal record of the purchase is the most crucial advantage of this document. This allows you to discover when a product was sold, who purchased it, and also who sold it.

2. Payment monitoring

A bill of sale is a significant accounting tool. It makes it easier for both the vendor and the purchaser to keep track of payments and amounts owing.

3. Legal safeguards

A valid invoice is legal documentation of a pricing agreement between the customer and supplier. It safeguards the merchant from bogus litigation.

4. Simple tax filing

Recording and keeping all sales invoices assists the firm in reporting its income and ensuring that the right amount of taxes is paid.

5. Business intelligence

Bill of sale analysis may assist organizations in gathering information from their customers’ purchasing behaviors and identifying trends, popular items, peak purchasing hours, and more. This aids in the development of efficient marketing tactics.

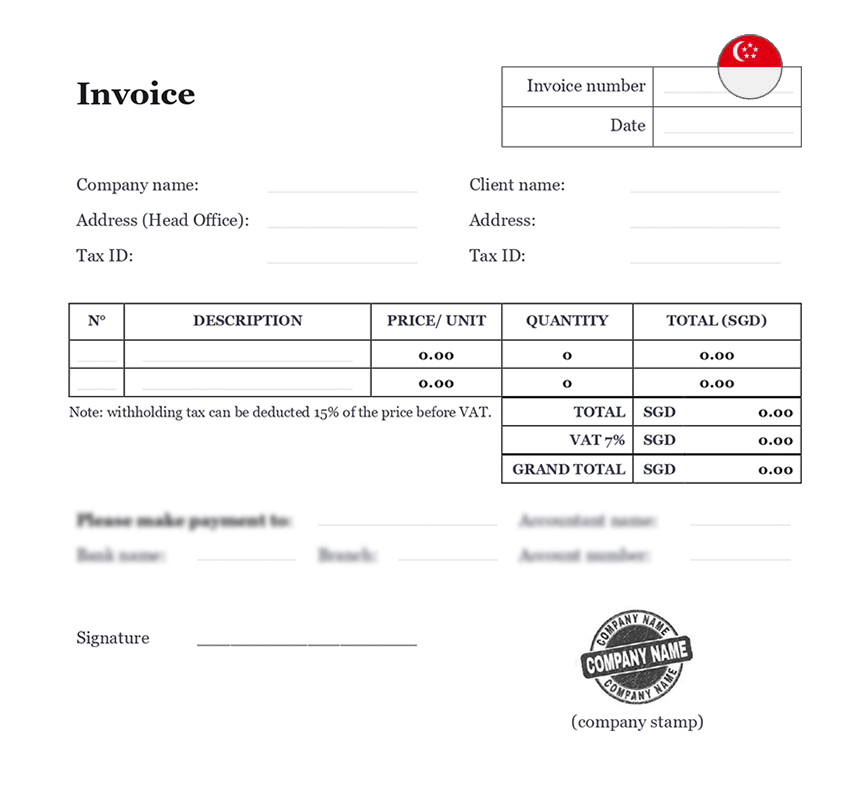

What does an Invoice include?

There is no defined structure for an invoice; nonetheless, invoicing regulations require a bill of sale to have the following fields (only pertinent fields must be filled):

| ➤ The supplier's name, address, and GSTIN |

| ➤ A consecutive serial number, in one or more sequence, containing alphabets or numerals or special characters such as hyphens, dashes, and slashes symbolised as "-" and "/" respectively, and any combination thereof, unique for a fiscal year |

| ➤ The date it was published |

| ➤ The recipient's name, address, and GSTIN or UIN, if registered |

| ➤ The recipient's name and address, as well as the address of delivery, as well as the name of the State and its code, if the recipient is not registered and the taxable supply is worth fifty thousand rupees or more |

| ➤ Goods HSN code or Accounting Code of Services |

| ➤ Items or services description |

| ➤ Quantities of products and units or Unique Quantity Code |

| ➤ Total value of products or services supplied or both |

| ➤ Subject to tax value of supply of goods or services or both, after any discount or abatement |

| ➤ The tax rate |

| ➤ The amount of tax levied on taxable products or services |

| ➤ Address of delivery, if different from the place of supply |

| ➤ Signature or digital signature |