Ready to use legal template

Work on without any hassle

Compliant with Singapore law

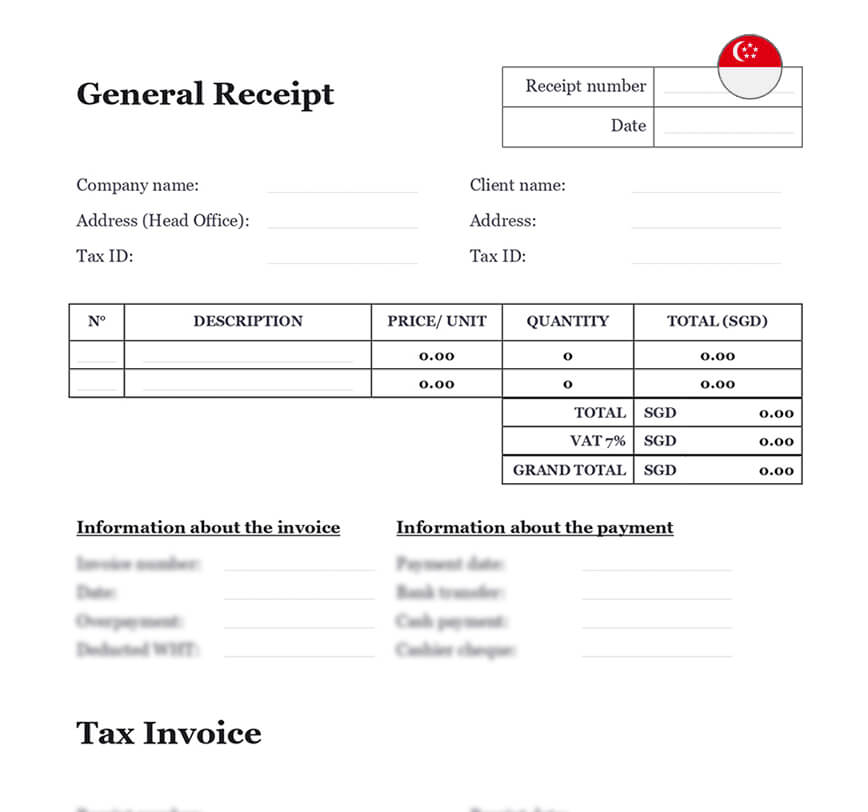

Home › Accounting services › General receipt

Learn more about General Receipt in Singapore

A General receipt, sometimes known as a “receipt,” is an acknowledgement of payment for a product or service. It is given to the customer who gets the commodity or service by the seller, who will produce an Invoice. When bills are produced and the client pays, it is typical for the lender to issue a payment receipt, which acknowledges receipt of money. A general receipt informs the client that the creditor has received the money owed. In other words, a general receipt serves as proof of payment for both the invoice issuer and the invoice recipient. Get a generic receipt template in compliance with Singaporean Accounting requirements from Themis Partner. You may also use the services of Our Accountants to help you handle your accounting.

📄 Related documents

Table of contents

What is a General Receipt?

A general receipt is a document that confirms receipt of something. It is frequently an invoice, or a duplicate of an invoice presented to the buyer by the seller with the words “delivered” or “paid” on it.

General receipts are an essential element of every business, freelancer, or individual’s daily existence. While the lack of an invoice or receipt may not appear to be significant, these papers constitute the cornerstone of accounting. One of the fundamental accounting rules is that there is no reporting without a receipt. A receipt’s purpose is to record company costs and material fluctuations. These receipts certify, make transparent, and intelligible a company’s activity. As a result, the general receipt is one of the most crucial papers for a business.

When a Rent Receipt is required, a separate document can be downloaded. Receipts are often straightforward and simply require the most basic information regarding the parties’ transaction.

How should a General Receipt be used?

This form may be used to create any sort of receipt. The document is designed to help with the following sorts of certificates: monetary receipts, document receipts, goods receipts, services receipts, and donation receipts. If none of these are valid, the receipt additionally contains a “Other” option, where details about the transaction underlying receipts can be provided rather freely.

Name and address data for each participant will be input first, followed by the kind of receipt. Following that, further information regarding the transaction will be requested to assist fill up the receipt.

Following that, the individual accepting receipt should sign the document, whether it is accepting receipt of money, documents, or items, for example. The original should be given to the person who did not sign it, and a copy should be preserved by both parties.

When should a Receipt be used?

| Completed Transaction | When products and/or services have been received and payment has been made, a general receipt should be used |

| Partial Payment Collection | If a partial payment is made for a debt, a receipt should include all of the usual information as well as the balance owed. A debt should be accompanied with a lending agreement or promissory note |

| Credit Card Transactions | Credit card machines generate an automatic receipt that is typically signed by the customer or validated with a pin |

| Cash Registers | Every cash machine should be capable of printing a standard receipt |

| iPayments | A general receipt should be provided to indicate evidence of purchase in circumstances where a physical receipt is not issued because money is transferred over the internet |