However, in some cases, it is possible to make an exemption of general meeting.

The board of directors and the members of the company can call a general meeting.

In fact, there are two possibilities for members to call a special general meeting:

1. Any member holding at least 10% of the total number of voting shares can ask the directors to call a special general meeting.

2. Or 2 or more members holding at least 10% of the total number of issued shares may call an extraordinary general meeting.

According to section 177 of the Companies Act 1967, if the company has no share capital, at least 5% in number of the members of the company or such lesser number as may be provided for in the articles of association of the company may convene a meeting of the company.

For extraordinary general meetings of private companies, a minimum notice period of 14 days is required for all meetings. However, for public companies, a 21-day notice period is required for special resolutions, although the company’s constitution may provide for a different notice period.

For annual general meetings, the notice period is 14 days.

The time limits are governed by sections 176 and following of the Companies Act 1967.

To be clear, these notice periods do not include the day on which the notice of meeting is served or processed for service, but include the day for which the notice is given.

For example, if a private company intends to hold an EGM to pass an ordinary resolution on January 15, the latest date on which notice of the EGM can be given is January 1. In this case, the 14-day notice period runs from January 2 to January 15.

If your company considers it necessary to have a shorter notice period, this is possible if a majority of the members who together hold at least 95% of the total voting rights agree.

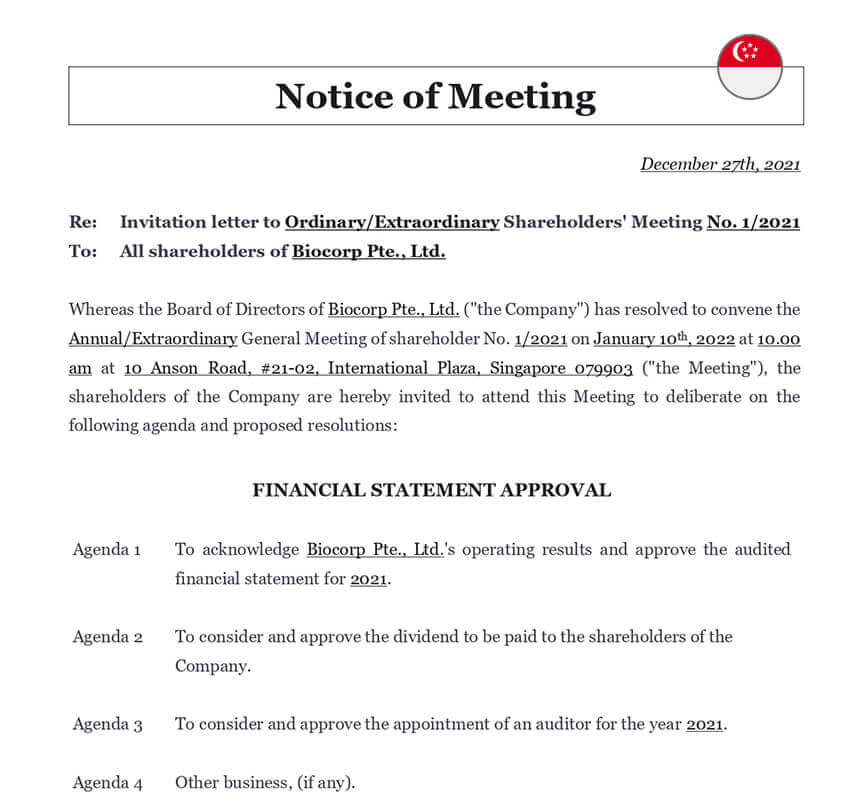

The purpose of the invitation letter is to inform the members of the corporation of the matters to be dealt with at the meeting. Therefore, the invitation letter must include the following information:

The corporation is required to send the notice of meeting in writing to all members of the corporation, whether or not they are entitled to vote at the meeting.

The articles of incorporation of the corporation generally provide for the method of sending the invitation letter. It may be sent by mail, so that the notice is deemed to have been given at the time of posting.

Electronic delivery, either by electronic transmission to the member’s current address (e.g., e-mail) or by electronic publication on a website (e.g., the company’s website) may be provided.

Thus, the invitation letter for an AGM may take different forms depending on what is provided for in the articles of incorporation:

Copies of documents such as financial statements, balance sheet, director’s report and auditor’s report must be sent to the shareholders in a timely manner.

According to the recent amendments to the Singapore Companies Act, a company can now send notices of meetings electronically. This change in provision will reduce costs and improve efficiency. The company’s articles of association will specify the method of electronic transmission (e.g., e-mail, fax, uploading the notice to the company’s website, etc.) of the notice which the company can set as the default method of sending.

Failure to comply with the requirements for holding an annual general meeting may result in penalties being imposed by ACRA. The Accounting and Business Regulatory Authority (ACRA) is the regulator of company registration, financial reporting, public accountants and business service providers and facilitates the establishment of businesses

Companies and individual directors may have the option of offsetting the violation, for example by paying a $500 fee per violation in lieu of facing prosecution.

In addition, a late filing fee will be assessed at the time of filing for each late filed return. This tax is $300 if the return is filed within three months of the annual return filing deadline, and $600 if it is not.

If the company and/or its directors do not accept the offer of reconciliation, or if AIDA chooses not to make an offer of reconciliation, the company and/or its directors may be subject to legal action. The company and/or its directors will be served with a summons to appear in court at a specified date and time, where they must either request a trial or plead guilty to the violations.

If the corporation and/or its directors are convicted of an offence, they may be fined up to $5,000 per count.

Indeed, the absence of an invitation letter is punishable to the extent that under section 180 of the Companies Act 1967, a member is, notwithstanding anything in the company’s constitution, entitled to attend any general meeting of the company and to speak on any resolution put to the meeting.

Can the court order a meeting?

According to section 182 of the Companies Act 1967, if for any reason a meeting has not been convened, the Court may, either on its own initiative or on the application of a director or a member who would be entitled to vote at the meeting or the personal representative of such a member, order that a meeting be convened.

It may also give such directions as it considers appropriate. For example, it may state that the representative of any deceased member may exercise any or all of the powers that the deceased member would have been entitled to exercise had he or she been present at the meeting.