What is the role of the annual general meeting document?

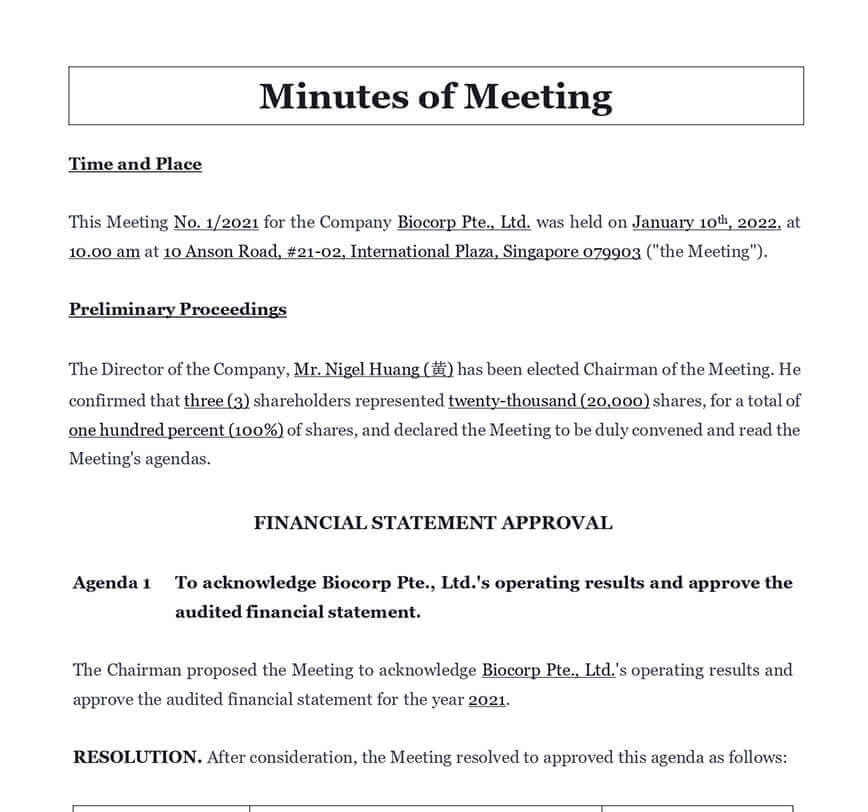

The minutes of meeting are a mandatory document, which must be drawn up during each general meeting of a company. This annual general meeting document summarize the subjects discussed and the results of the deliberations. They must be signed and initialed by all the partners. The minutes of meeting are an element of proof of the holding of the meeting by the shareholders in accordance with the company’s articles of association and allow the identification of the shareholders present, represented or absent.

In addition, the annual general meeting document constitute a record of the decisions taken at the meeting and the actions that the company will have to take in the future. It is therefore a documentary evidence for the auditors; a record of the powers granted to certain persons during certain transactions. The annual general meeting document is usually taken by the company secretary, but this role can also be assumed by any company officer present at the meeting.

What is the importance of the annual general meeting document?

The annual general meeting document serve as a summary of the proceedings of the meeting for all directors, members and shareholders who attended or were unable to attend the meeting, indicating who made what decision(s) and why, and who is responsible for acting on them. This allows members and shareholders to review the proceedings of the meeting.

By being conclusive evidence of the responsibility assigned and authority given to specific officers, the officers can be identified in the event of a breach of duty.

The annual general meeting document is also legal documents that the company’s auditors rely on to verify who approved transactions at the meeting.

In Singapore, every company (whether private or public) is required to keep minutes in books (i.e., minute books) within one month after the meeting. The annual general meeting document is bound together and recorded by the secretary of the company. Indeed under Section 189 (1) of the Companies Act 1967, the annual general meeting document must be kept by the company at its registered office, or at the company’s principal place of business in Singapore, and must be open to inspection by any shareholder without charge. Such meetings may be shareholders’ meetings, e.g. special general meetings or board of directors’ meetings.

How do I record annual general meeting document?

ℹ️ The style, formatting and content requirements for annual general meeting document are unique to each company.

Regardless, ideally, the annual general meeting document should be written in a way that makes it easy for anyone to follow the discussions and understand how and why certain decisions were made. A verbatim record is not expected. However, key points of the discussions, such as the final decision, opposing views of members, and any other background information sufficient for future reference, should be recorded.

What should the annual general meeting document contain?

A distinction can be made between the general content of the annual general meeting document of general shareholders’ meetings and those of directors’ meetings:

General meeting of shareholders

The minutes of a shareholders’ meeting must contain:

| ➤ The names of directors, members, shareholders, officers as well as proxies (persons who make corporate decisions on behalf of members absent from the meeting) |

| ➤ A statement of the quorum present. A meeting cannot be held without a quorum |

| ➤ A record of members consenting to the reading of the notice of meeting |

| ➤ A record of the chairman's opening remarks |

| ➤ The recording of the chairman's summary statement at the meeting prior to the discussion of the business transactions |

| ➤ Approval of business transactions by resolution. For ordinary resolutions, approval by a majority of at least 50% of the votes cast is required. For special resolutions, approval is required by a majority of at least 75% of the votes cast |

| ➤ Interactions between the chairperson and any of the persons present, such as issues raised, questions asked, clarifications requested, etc |

| ➤ The number of votes for and against the resolution |

| ➤ The vote of thanks at the end of the meeting by the chairperson to the attendees for their support of the corporation's decisions |

| ➤ The chairperson's signature at the end of the minutes. It authenticates and recognizes the conduct of the meeting |